In Texas, selling a condemned house can be challenging, but it can be accomplished successfully. Hazardous issues and code concerns may need to be addressed, and understanding the details involved in these types of sales is essential. House Buyers RGV can help homeowners navigate the process while remaining within the boundaries of local laws when selling a condemned house. Although selling a property with these restrictions may feel overwhelming, identifying potential buyers and addressing key issues can help generate a return and provide a sense of relief.

Understanding What “Condemned” Means in Texas

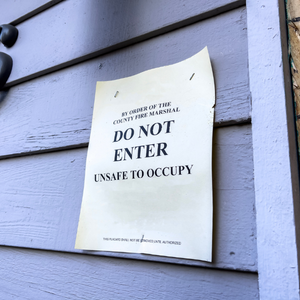

It’s not easy to sell a house that is condemned in Texas, and knowing what “condemned” means is important. In Texas, a condemned house refers to a property that is legally unfit for people to live in for a variety of reasons and problems. Homeowners must know the details of house condemnation in Texas, as well as the property’s legal description. This will help you understand the legal issues and address the concerns of potential buyers regarding the property’s condition and code enforcement issues. Examine the legal description of a condemned house and the common reasons homes are condemned in Texas.

The Legal Definition of a Condemned House

A house in Texas that has been condemned means the property has been determined by a government agency as unfit for occupancy due to a significant number of code violations. A condemned house means the property poses severe structural or health risks, leading government officials to order it condemned. Such properties end up in a noncompliance status, which is why condemned houses are a major legal issue in Texas. Every house found to be in violation of the local building codes is subject to a condemnation order due to the threat to public health and safety. Texas property laws state that any house that has been condemned must have its status disclosed as it enters the marketplace. This legal definition of a condemned house protects the transparency rights of potential buyers.

In Texas, condemnation of houses involves assessments done by local governmental agencies or building inspectors. If any issues arise, then that begins the process that determines whether the house will become a condemned property. Homeowners face challenges when trying to conceal the property’s condemned status from potential buyers. Even though it is possible to sell, the legal definition of the property means it is a matter of fact that buyers understand the property at issue. Knowing this will help homeowners understand the condemnation process, the protection of their property rights, and the impact on the expected sale of the property.

Common Reasons a House Becomes Condemned in Texas

In Texas, homes can be condemned for various reasons. The primary reasons usually involve code violations from structural, electrical, or plumbing issues. Over time, neglect can cause serious damage that can turn a livable home into a condemned house. This problem is worsened by the severe weather that Texas is known for, making homes prone to neglect. Without maintenance, a home can become condemned by officials.

In Texas, home deterioration can result from caving roofs or failing water systems. In high wind or flood zones, these conditions can become a threat. In Texas, the weather is humid. Mold can grow and lead to the home being condemned. The conditions of a home should be repaired consistently, which prevents the home from becoming condemned. The city officials should be addressed, as this can mitigate code violations. Texas laws can be abided by taking these measures. Legal issues can be mitigated by taking the necessary steps.

To effectively safeguard their properties from the threat of condemnation, homeowners in Texas can consider the following practical steps:

- Maintain and repair the property’s structural components to avoid issues arising from deferred maintenance.

- Monitor current local zoning laws and any updates to the surrounding neighborhoods.

- Participate in community meetings and express any concerns related to the potential construction projects.

- Provide for the best construction of the roof and plumbing systems to avoid any construction violations.

- Develop and maintain a good working relationship with the local government regarding its policies on land use.

- Keep extensive records of the improvements and maintenance performed on the property.

- Join local associations of homeowners to gain insight into the current concerns of the community.

- Obtain the necessary permits as a way of conforming to the regulatory laws of the locality.

By adopting these measures, homeowners can strengthen their defenses, ensuring their properties remain well-protected and aligned with municipal standards.

The Condemnation Process in Texas: An Overview

Homeowners face a complex process when it comes to house condemnation in Texas. Texas law is complex when it comes to legal steps that affect a homeowner’s property rights. From inspection to resolution, a homeowner’s understanding of condemnation helps inform the authorities’ options. This overview will provide an understanding of the process of condemnation and the legal ramifications of house condemnation, and the legal strategies and probable outcomes that energy homeowners to sell a house before it becomes condemned.

| Key Step | Description | Impact on Homeowner | Legal Considerations |

|---|---|---|---|

| Notice of Intent | The government’s offer must reflect fair market value, and homeowners have the right to challenge this valuation. | Homeowners are informed about the potential loss of property and can start preparing for the legal process. | Notice must comply with statutory requirements to ensure due process is followed. |

| Appraisal and Offer | An appraisal is conducted to determine the property’s value, followed by an official purchase offer. | The valuation affects the compensation homeowners may receive, impacting financial plans. | Homeowners must vacate the property, but receive compensation for the condemned property. |

| Negotiation | Homeowners can negotiate the offer with the government to seek fair compensation. | During this stage, homeowners have an opportunity to improve their financial outcome. | Homeowners are entitled to negotiate and may require legal counsel to ensure fair treatment. |

| Eminent Domain Filing | If negotiations fail, the government files a court petition to take ownership of the property. | The legal action escalates the situation, which may increase stress and urgency for homeowners. | The court oversees the process to ensure statutory compliance and fair compensation. |

| Special Commissioners’ Hearing | A hearing with appointed commissioners determines the property’s fair market value. | Homeowners can present evidence and testimony, which can influence the final compensation amount. | This quasi-judicial process allows both parties to argue their positions on valuation. |

| Possession and Payment | Once compensation is determined, the government takes possession after payment is made. | Payment must occur concurrent with or before possession, ensuring the homeowner is compensated in a timely manner. | Payment must occur concurrent with or before possession, ensuring the homeowner is compensated timely. |

This table captures the intricate steps of the condemnation process and their direct effects on homeowners within Texas.

Key Steps in the Condemnation Process in Texas

A house is condemned after local authorities report safety violations at the property. Inspectors evaluate structural integrity, health hazards, and building code violations. An unfit structure will receive a condemnation order, starting the house condemnation process. Homeowners can repair the property, or an eminent domain action can take place where the government will take the Texas property for its own use. Homeowners are issued repair violations after the condemnation order is issued, and homeowners are notified of the steps to take to lift the condemnation status. Homeowners are legally obligated to disclose the condemnation status and face a time constraint to sell the home to avoid further legal repercussions, such as the court placing a lien to collect the fines or the government selling the home to settle the fines.

Legal options are available to homeowners during the sanctions, and they are the first step in the process. Texas homeowners have the right to a condemnation order appeal and to negotiate legally with the authorities. Properties are bought as-is, and offers are negotiated for cash and for expedited property sales. The Texas property condemnation order assigns a value to the property, and these properties can be bought without the repairs. These steps are for homeowners with condemned properties to plan their forward actions and finish the process to avoid further complications.

How the Condemnation Process Affects Homeowners

Condemnation is an emotionally taxing time for homeowners as they face losing not just their home, but also the rights that come with ownership. Once a home is condemned, selling it becomes complicated as buyers must be notified of the condemnation, which is not typical for most buyers. For homeowners, they may be left with the financially burdensome task of obtaining the condemnation of the home as their problem. Home sellers in Texas are legally limited to their equity, as the market value of an encumbered home may be very low. This may further affect the owner emotionally, as it may be too distracting to have to deal with the authorities as they assess the home and bring the owners to focus on the years of damage and neglect.

Although being a Texas seller comes with challenges, there is the opportunity of gaining something through the condemnation process. Homeowners may be entitled to compensation when their property is taken through eminent domain for public projects. Knowing about these opportunities is key to protecting individual property rights. Legal counsel can provide strategies to contest the orders, while alternative sales approaches with cash offers to investors enable the owner to quickly regain control and obtain financial relief. The best options in a challenging situation are formed while focusing on the impact this process has on homeowners.

Challenges of Selling a Condemned House on the Traditional Market in Texas

Selling a condemned house is a strenuous task due to how buyers perceive the property. The damage and code violations commonly found in condemned homes cause many potential buyers to lose interest. In addition to the condition of the property, market conditions can create further obstacles, with traditional buyers often unwilling to invest significant money into heavily distressed homes. Working with a company that buys homes in Los Fresnos or nearby cities can provide an alternative solution for sellers who want to avoid these challenges. Understanding the obstacles in the condemned housing market is vital for Texas homeowners, as selling these properties requires awareness of local risks, regulations, and buyer expectations.

Why Traditional Buyers Avoid Condemned Houses

Traditional buyers typically avoid buying condemned houses because of the enormous complexity of the condition of the property and the financial problems they present for the buyer. When dealing with a property in Texas that is condemned and uninhabitable, there are severe structural issues and code violations. Because of this complexity, buyers are discouraged. Many buyers want to purchase houses that are in good condition and that they can do a little bit of work on or problem solve. They do not want to engage in extensive renovations. Texas law keeps buyers and sellers in a complicated situation because of the law’s demands and the seller’s need for a quick and easy sale. There are also Texas sellers who face financing issues because traditional banks do not lend money for condemned houses, as they are not livable, and the house does not meet standard lending requirements.

The stigma attached to specific areas, including a condemned house’s location, is apparent. Buyers may avoid the house because they want to ensure a good resale value, and there is a risk that the condemned house may not be worth much in the future. A risk may outweigh any potential appeal, including a good resale value, and further, this risk can create a greater perception of problems for buyers. Buyers also value a simple, clear, and direct purchasing process, so the existing value in the house is lower than the risk, and the alternatives look better than a condemned house. Because of this, buyers avoid condemned properties in Texas.

The Impact of Market Conditions on a Condemned House Sale in Texas

In Texas, the sale of a condemned house is affected by the current state of the housing market. If the market is at the peak of its cycle (the market is booming) and demand for houses is high, buyers may avoid a condemned house, as they typically opt for houses in better condition. In these situations, it is extremely difficult for homeowners to obtain a cash offer. Cash offers, on the other hand, are extremely generous because of the buyer’s inability to obtain a loan, as financing is typically the most difficult part of the buyer’s process. This is an example of a Texas seller’s market that Texas sellers are facing. When the market is at the other end of the spectrum, buyers may see a condemned house as an acceptable risk (as they may want to risk the house for future profits). In these situations, the condemned house can provide opportunities for opportunistic buyers and desired opportunities for Texas sellers.

In Texas, properties with condemned buildings are affected by the market’s state in stagnant cities experiencing economic depression and cities experiencing significant revitalization. In revitalizing cities, developers can purchase condemned houses at lower prices due to redevelopment potential. In Texas, there is a requirement for full disclosure of any damages concerning any house in Texas. Therefore, homeowners should familiarize themselves with market conditions and approach buyers directly to expedite the sale and minimize their losses.

The Role of the Texas Seller’s Disclosure Notice

Knowing how to use the Texas Seller’s Disclosure Notice when selling a condemned house is invaluable, especially when understanding how to sell a distressed property properly and legally. Texas Seller’s Disclosure Notices provide buyers with insight into the property’s condition and the condemnation provisions under Texas law. Sellers are required to disclose known defects, including those that led to the condemnation. As a seller, understanding what to include and how to complete the notice accurately helps build trust and demonstrate good faith. This section explains the process in detail, including how to avoid legal issues and ensure the sale moves forward smoothly.

What Information is Required in a Disclosure Notice in Texas

Texas Seller’s Disclosure Notices, while important for all properties, hold particular relevance for condominiums. This is because the state of Texas’s seller disclosure laws require Texas sellers to disclose their properties in full, including particulars of any property order of condemnation. Per the Texas seller property disclosure, code violations, seller disclosures, and all plumbing, foundation, or related issues must also be documented. This is an important seller disclosure law as it informs the Texas property buyer of the true state of the property. The seller disclosure also allows Texas sellers to include any other legal definitions, rights, or options related to the seller’s property or purchase, including a right to compensation consumer, the right of eminent domain. This thorough documentation builds trust and transparency.

Texas law also states that sellers must disclose any pertinent external and environmental safety concerns about the property, including the potential for flooding or exposure to hazardous materials and toxic substances. Failure to complete disclosure documents correctly can create arduous challenges for the property sale; therefore, it is always best practice to engage a professional consultant to mitigate the risk of losing important and valuable property seller disclosure information. Seller disclosures work to limit seller disputes and disclose the true condition of the seller’s property. This information is used to increase the transparency of a seller’s property and increase the possibility of success for the sale.

Can I Sell My Condemned House in Texas?

Although there are obstacles when selling condemned property in Texas, it is still legally possible to do so and likely to be successful when properly approached. When selling a house that is under fire from a condemnation order, there are many obstacles that must be overcome. Texas sellers certainly face a difficult and complicated market, with easily available and completely legal cash offers to buyers to minimize risk as much as possible, with buyers practically encouraged to limit their offers. Once the seller faces the extreme difficulties in getting a property sold because of its condition, it allows the seller to move on with their life.

Legal Options for Selling a Condemned Property in Texas

It is important for Texas homeowners to understand each option available legally when they have to sell a condemned property. After a property goes under a condemnation order, sellers can still engage in direct negotiations with as-is cash home buyers. Contracting with these types of buyers means doing less work as they take care of large repairs. As-is buyers do not have to address the friction of obtaining a mortgage, since they buy the home with a cash offer, allowing them to close more quickly.

If a Texas property is condemned under eminent domain, the homeowner is legally entitled to receive compensation. In this case, the city may be looking to take the condemned property to put in a public work. While this process may be complex, the homeowner is typically compensated at the property’s fair market value prior to the condemnation, which can be a financial relief. Speaking to city officials can be valuable in determining whether this option is viable. Understanding condemnation can be legally complicated. It is recommended to work with a Texas attorney to discuss options to improve the terms of an appealed condemnation in order to provide an outline for the sale. This will prevent future legal problems.

You may encounter serious challenges when selling a condemned home in Texas; however, positive outcomes are possible with the right approach, helpful resources, and a clear legal path forward. Focus on understanding local regulations, balancing repair costs versus selling price, and exploring direct as is selling options to investors, including cash home buyers in Brownsville or nearby cities who specialize in redevelopment opportunities. This strategy can provide peace of mind while helping you maximize the value you can achieve. With additional guides available for download and consultation resources to support you, the tools are in place to help you reach a successful closing and move toward a stronger financial future.

FAQs

What does it mean for a house to be condemned in Texas?

In Texas, a condemned house is a house that a government authority has designated as being unfit for human habitation due to large-scale health or structural code violations.

What are common reasons for house condemnation in Texas?

Significant damage can occur due to lack of maintenance or neglect, structural deficiencies, and electrical or plumbing issues. Such conditions can lead to a condemnation order, especially when combined with severe weather.

How does the condemnation process affect the sale of a house in Texas?

The seller’s legal duty to explain any existing legal violations regarding the property and the repairs needed creates an additional burden on the seller and most likely diminishes the buyer’s interest. On top of that, it makes the process of selling the property that much more complex.

What legal options do homeowners have when selling a condemned house in Texas?

Homeowners can negotiate with specialized buyers offering cash deals for as-is properties. They can also explore compensation options if the property is acquired under eminent domain, potentially providing financial relief.

Why do traditional buyers typically avoid condemned houses in Texas?

Most conventional buyers stay away from boarded-up houses because they require a ton of work to be brought up to code. This requires financial and regulatory work on the buyers’ part. In addition, the houses in question typically do not qualify for traditional financing, which adds even more complications.

Need to know how to sell a condemned house quickly and without dealing with costly repairs? House Buyers RGV is here to help. We offer fair cash offers, handle all the details, and make the process seamless from start to finish. You can sell your property as is without fixing code violations or structural issues. Ready to sell or have questions? Contact us at (956) 255-8168 for a no-obligation offer. Get started today!